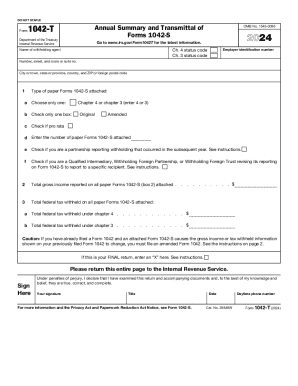

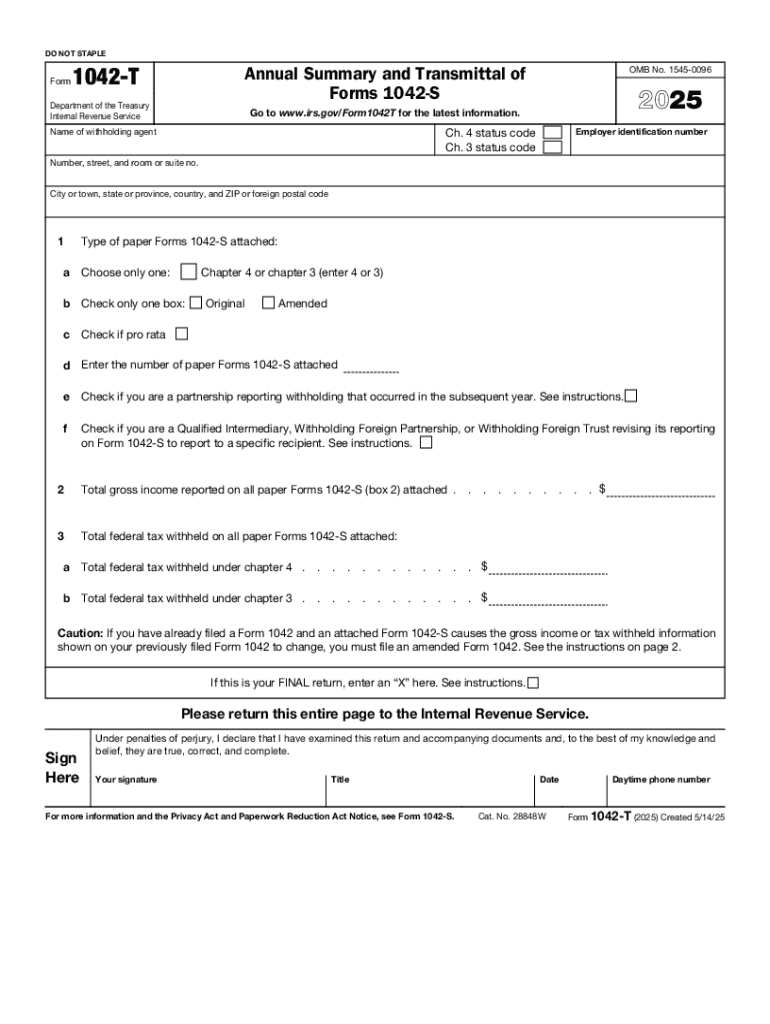

IRS 1042-T 2025-2026 free printable template

Instructions and Help about IRS 1042-T

How to edit IRS 1042-T

How to fill out IRS 1042-T

Latest updates to IRS 1042-T

All You Need to Know About IRS 1042-T

What is IRS 1042-T?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1042-T

What should I do if I need to correct a mistake on my IRS 1042-T?

If you need to correct a mistake on your IRS 1042-T, you should file an amended version of the form. Ensure that you clearly indicate that the submission is a correction and provide the correct details. Follow the IRS guidelines for amendments to ensure proper processing.

How can I verify the receipt of my IRS 1042-T filing?

To verify the receipt of your IRS 1042-T filing, you can check the status through the IRS e-file portal if you submitted electronically. Common rejection codes can also indicate issues, and you should be prepared to resolve those promptly. Keeping a record of submission confirmation can help track your filing status.

What are the e-signature requirements for filing the IRS 1042-T?

When filing the IRS 1042-T, e-signatures are acceptable if you comply with IRS standards for electronic submissions. Be sure to follow guidelines on record retention and data security to ensure your filing is valid and protected.

What steps should I take if my IRS 1042-T submission is rejected?

If your IRS 1042-T submission is rejected, review the rejection notice for specific reasons. You may need to correct errors in your form or check compatibility with the e-filing software you used. Following the appropriate steps for resubmission will help alleviate any issues with the IRS.